Japanese Candles” is a phrase that is well known among the trading cammWlity. If the phrase is searched on the Internet, 3,810,000 searches are available in the Google search engine today. In comparison, if Ichimoku” is searched, 141,000 searches appear, which is quite a difference. Steve Nison brought Japanese Candlesticks to the Western world and did a greatjob illustrating how it can be used to become a successful trader. He left a huge mark on the trading community, and today institutions down to the average retail trader use Japanese Candlesticks in some form or fashion in their technical analysis.

This book brings Ule next phrase of Japanese technical analysis to the Western world, Ichimoku Kinko Hyo.” Ichimoku Kinko Ryo is a system Umt has been used successfully throughout Japan for years but never has progressed fOr\vard in the Western world. If a trader combines Japanese Candles with Ichimoku Kinko Byo, a powerful system is available to him or her. In fact, it increases the probability of trading drastically and can be evidenced by trading in a “paper” account after reading this book Japanese Candlesticks will not be discussed further in this book and any additional infomlation regarding this topic is avaiJable through Steve Nison’s books and training seminars.

Content :

Background

Components of a Trading System

Ichlmoku Components

Tenkan Sen

Kijun Sen

Chikou Span

Kumo Cloud Components

Senkou Span A

Senkou Span B

Kumo Cloud

Ichlmoku Trading Plan

Components

Strategy Description

Backtesting

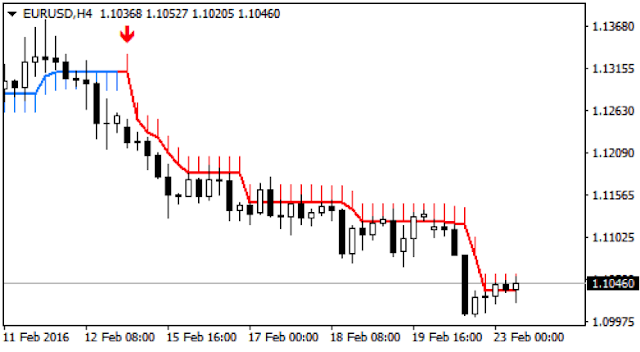

EURUSD-A Two-Year Backlest

Summary-Two Years of Backtesting

Examining the Backlest Results

Optimize Trading Plan

lchimoku Strategy

Ichlmoku ‘I’tme Elements

Ichimoku Time Elements

Doug Laughlin

Is It as Easy as Just Being Taught a New System?

The Problem We Have with Getting in Our Own Way

Is There a Conspiracy Against the Small Trader?

Traders Myth-Smart People Make the Best Traders

Losing Trades Are Acceptable

A Successful System Will Fortify Your Convictions

Self-Sabotage and How It Applies to Your Trading

In Summary-Trader Psychology Overall

Consequences of Trading without a Trading Plan

Trading Plan

Backtesting

Conclusion

Ichlmoku Anulysls Sheet

This book brings Ule next phrase of Japanese technical analysis to the Western world, Ichimoku Kinko Hyo.” Ichimoku Kinko Ryo is a system Umt has been used successfully throughout Japan for years but never has progressed fOr\vard in the Western world. If a trader combines Japanese Candles with Ichimoku Kinko Byo, a powerful system is available to him or her. In fact, it increases the probability of trading drastically and can be evidenced by trading in a “paper” account after reading this book Japanese Candlesticks will not be discussed further in this book and any additional infomlation regarding this topic is avaiJable through Steve Nison’s books and training seminars.

Content :

Background

Components of a Trading System

Ichlmoku Components

Tenkan Sen

Kijun Sen

Chikou Span

Kumo Cloud Components

Senkou Span A

Senkou Span B

Kumo Cloud

Ichlmoku Trading Plan

Components

Strategy Description

Backtesting

EURUSD-A Two-Year Backlest

Summary-Two Years of Backtesting

Examining the Backlest Results

Optimize Trading Plan

lchimoku Strategy

Ichlmoku ‘I’tme Elements

Ichimoku Time Elements

Doug Laughlin

Is It as Easy as Just Being Taught a New System?

The Problem We Have with Getting in Our Own Way

Is There a Conspiracy Against the Small Trader?

Traders Myth-Smart People Make the Best Traders

Losing Trades Are Acceptable

A Successful System Will Fortify Your Convictions

Self-Sabotage and How It Applies to Your Trading

In Summary-Trader Psychology Overall

Consequences of Trading without a Trading Plan

Trading Plan

Backtesting

Conclusion

Ichlmoku Anulysls Sheet